Strategy Overview

- Invests in equities across the market capitalization spectrum utilizing an absolute return based framework

- Comprised of 30-40 holdings with low average turnover since inception of 31.1%

- Focused on high quality businesses with sustainable earnings growth and conservative balance sheets

Characteristics

| Market Cap (Wtd Avg) | Market Cap (Median) | Price/Earnings Ratio (TTM) | Price/Book Ratio | Current Yield | Return on Equity | Active Share | |

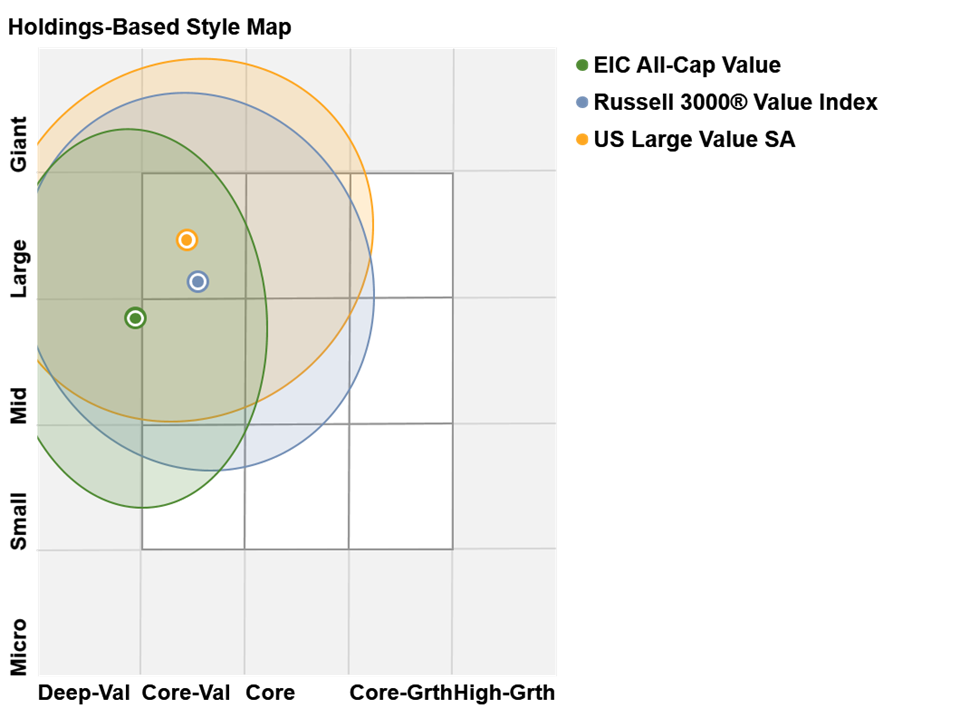

| EIC All-Cap Value | $74.1B | $41.3B | 15.3x | 2.0x | 3.3% | 15.0% | 94.1% |

| Russell 3000® Value Index | $384.7B | $2.3B | 18.9x | 1.7x | 1.9% | 7.5% | – |

Performance

| All-Cap Value (Gross*) |

All-Cap Value (Net*) |

Russell 3000® Value Index |

|

| 1 year | 17.2% | 16.0% | 15.7% |

| 3 years | 14.6% | 13.5% | 13.8% |

| 5 years | 14.9% | 13.7% | 11.2% |

| 10 years | 12.0% | 10.9% | 10.5% |

| Since Inception | 11.8% | 10.7% | 10.4% |

as of 12/31/2025

*Returns are for EIC’s All-Cap Value (“ACV”) Composite, which includes fully discretionary, non-wrap accounts presented as supplemental information to a GIPS® Composite Report that is considered an integral part of the above presentations. ACV returns are presented both gross and net of management fees. Net returns are calculated by reducing gross returns with an assumed maximum annual fee of 1.0%, applied monthly. However, for the period January 1, 1989, through July 1, 1995, wrap fee accounts are included in the composite. For this period gross returns for wrap accounts are stated gross of all fees and brokerage firm wrap fees, while net returns have been calculated by reducing gross returns with an assumed maximum annual fee of 1%. ACV strategy inception: January 1, 1986. Indexes are unmanaged, do not incur management fees, costs and expenses, and cannot be invested in directly. All returns include reinvestment of dividends and interest. Performance data is historical. Past performance does not guarantee future results. Current performance may be lower or higher than the performance quoted. Investing involves risk including possible loss of principal.

Portfolio data is from a representative All-Cap Value account and is presented as supplemental to a GIPS® Composite Report that is considered an integral part of the above presentation. Individual portfolio characteristics may vary from that of the representative portfolio. All characteristics are calculated on a gross basis. All characteristics except for Weighted Average Market Capitalization, Current Yield, Active Share and Annual Turnover are median values. Current Yield is the weighted average of each stock’s current yield. Current yield of a stock is the annual dividend per share divided by price per share. Price/Earnings Ratio shows the multiple of earnings at which a stock sells as determined by the ratio of the company’s most recent month-end share price to the company’s earnings per share for the trailing twelve months (TTM). Price/Book ratio shows a company’s most recent month-end share price to the company’s book value per share for the trailing twelve months. Book value is the total assets of a company, less total liabilities. Return on Equity is the percentage a company earns on shareholder’s equity. Net income divided by average shareholder’s equity indicates how effectively management has invested shareholder’s equity. Active Share measures the percentage of holdings in a representative All-Cap Value portfolio that differ from the benchmark holdings either in name or weight on December 31, 2025. Annual Turnover represents the average percentage of a representative portfolio’s holdings that have changed annually since the strategy’s inception.

Russell Index information is from S&P Capital IQ PRO. London Stock Exchange Group plc (“LSE Group”) is the source and owner of FTSE Russell index data. FTSE Russell is a trading name of certain of the LSE Group companies. “Russell®” is a trade mark of the relevant LSE Group companies and is used by any other LSE Group company under license. All rights in the FTSE Russell indexes or data vest in the relevant LSE Group company which owns the index or the data. Neither LSE Group nor its licensors accept any liability for any errors or omissions in the indexes or data and no party may rely on any indexes or data contained in this communication. No further distribution of data from the LSE Group is permitted without the relevant LSE Group company’s express written consent. The LSE Group does not promote, sponsor or endorse the content of this communication.